The American West is Diversifying its Energy Portfolio

/Image: ACORE

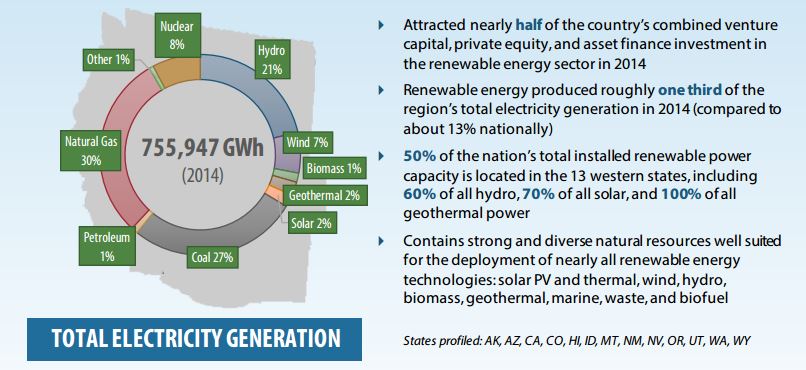

The American Council on Renewable Energy's 2015 report on western energy markets makes a convincing case that states in the American West are increasingly reliant on renewable energy sources. Per the graphic shown above, the 13 western states accounted for half of the nation's installed renewable energy capacity, and half of the nation's private sector investments in renewable energy. One factor driving the growth is the West's sheer size and renewable energy potential - the 13 western states encompass half the land area of the United States, including major river systems like the Colorado, Columbia, and Missouri, mountain ranges like the Rockies and Sierra Nevada, rainforests, volcanoes, deserts, and the Pacific coast. The region is undeniably blessed with natural resources.

But the ACORE report also cites connectivity and inter-dependence as a major driving force behind energy diversification in the American West:

It is increasingly evident that the electric grids of western states are interdependent and complementary. To take fullest advantage of renewable supplies, fully utilize existing transmission infrastructure and manage costs to ratepayers, grid operators and regulators are looking to move towards an integrated western grid.

Energy generation is only one side of the 'energy holy grail.' The other is energy storage and delivery, where the energy industry would like to see more integration:

“We don’t want to do this necessarily the same way we did solar policy, where every single state in the nation has a different framework,” said Madeleine Klein of SoCore, a solar developer owned by Edison International [...] For solar developers to operate in 50 states, Klein said, they have to navigate 50 different markets, with 50 different sets of regulations. “We want to try to avoid that for storage, so that you’re looking at effectively the same market structure regardless of whether you’re looking at a northeast project or a southwest project.

It looks like the western states are moving towards an integrated energy framework. The Energy Imbalance Market (EIM) aims to share renewable energy across state lines to accommodate for fluctuations in renewable energy generation and demand. Several major utilities in California, Oregon, Washington, and Utah are already participating in the EIM, and others in Idaho and Nevada are thinking about joining up as well. This integration might even prompt the western states to develop a regional compliance plan under the Environmental Protection Agency's Clean Power Plan requirements:

There are strong incentives for states throughout the western interconnection to cooperate on resource planning, transmission infrastructure, and development of a common emissions trading infrastructure. A regional plan would likely be more cost effective and enable states to access higher-impact and lower-cost carbon reductions in other states.

There's no question that a transition to renewable energies will be challenging (Bill Gates recently said it would take a miracle), and it will be interesting to see how the American West, with its vast natural resources and great distances between population centers, addresses the demands of energy generation, storage, and delivery.